nc sales tax on food items

Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. The state sales tax rate in North Carolina is 4750.

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

The transit and other local rates do not apply to qualifying food.

. Nc sales tax on non food items Monday March 14 2022 Edit. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Items subject to the general rate are also subject to the. You own a grocery store in Murphy NC.

Counties and cities in North Carolina are allowed to charge an additional local sales. Nc sales tax on food items Tuesday March 29 2022 Edit. This page describes the taxability of.

The base state sales tax rate in North Carolina is 475. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. It is not intended to cover all provisions of the law or every taxpayers specific circumstances.

Nc sales tax on food items. 105-164310 are exempt from the State sales and use tax and. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent.

With local taxes the total sales tax rate is between 6750 and 7500. Sales by non-profits conducted annually for. Sales Tax Collections on Food and Prepared Food In Millions 1087 1129.

A More than 80 of the sellers gross receipts are from the sale of food. The information included on this website is to be used only as a guide. A customer buys a toothbrush a bag of candy and a loaf of bread.

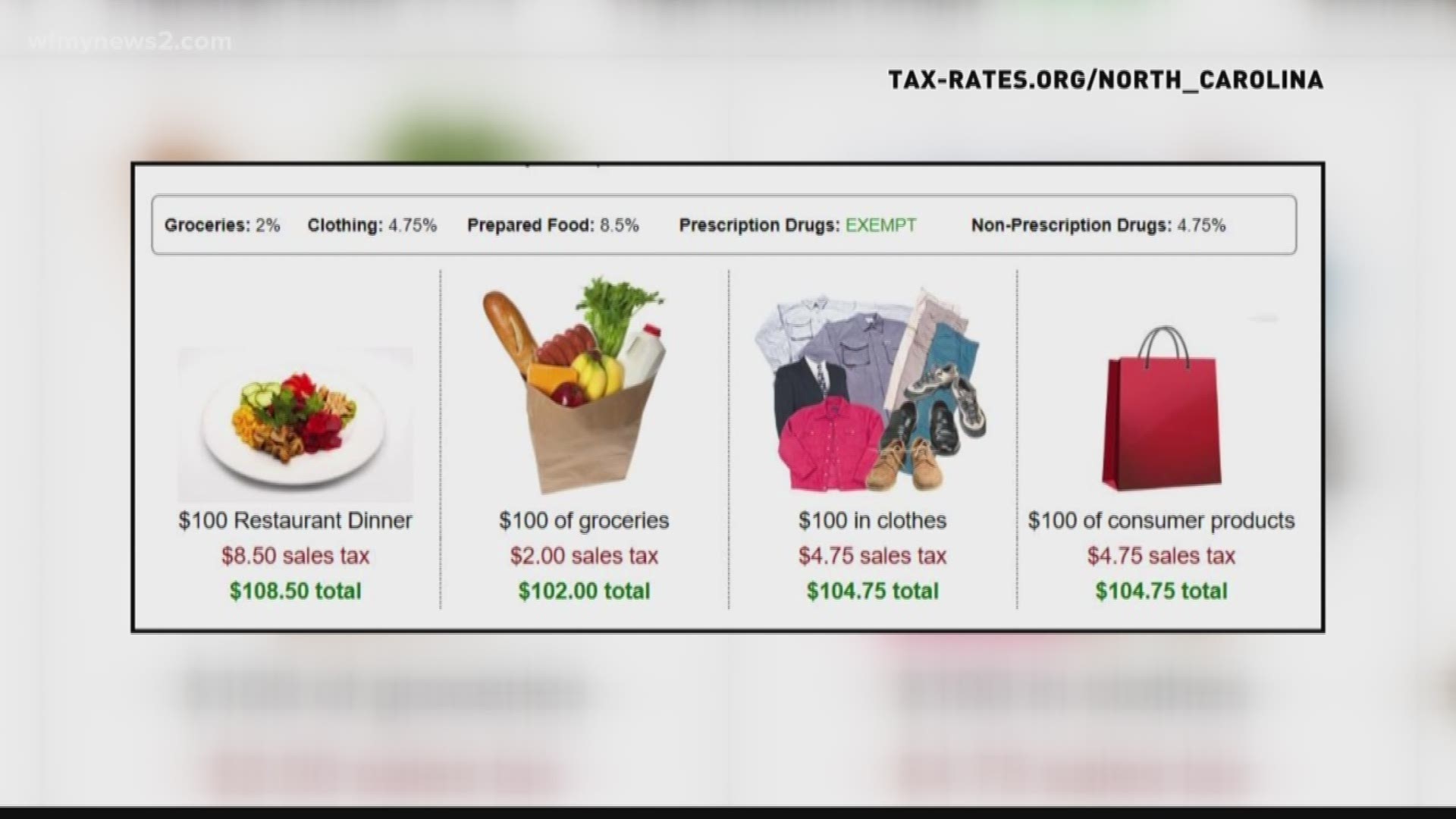

A customer living in Cary North Carolina finds Steves eBay page and purchases a 350 pair of headphones. The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on. These categories may have some further qualifications before the special rate applies such.

North Carolina has recent rate changes Fri Jan. The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200. Candy however is generally taxed at the full combined sales tax rate.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2. The sales tax rate on food is 2.

Pin By Alexa On Life Hacks Poster Movie Posters Life Hacks Sales Tax On Grocery Items Taxjar. Is Food Taxable In North Carolina Taxjar Sales Tax On Grocery Items Taxjar Sales Tax On Grocery Items Taxjar. When calculating the sales tax for this purchase Steve applies the.

North Carolina sales and use tax law provides an exemption for sales of mill machinery machinery parts and manufacturing accessories however these items are subject. 53 rows Table 1. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Lease or Rental of Tangible Personal Property. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. FY2004-05 FY2005-06 FY2006-07 FY 2007-08 FY 2008-09 I n M i l l i o n s Prepared Food.

The taxability of cold food sold to go in California depends in large part on the 80-80 rule. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Sales and Use Tax Sales and Use Tax.

Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Food Non-Qualifying Food and Prepaid Meal Plans.

Sales Tax On Grocery Items Taxjar

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Tax Free Week Starts Today For Hurricane Supplies Be Prepared Now Instead Of Waiting Until A Storm Is Hea Plastic Drop Cloth Hurricane Supplies Disaster Prep

North Carolina Sales Tax Small Business Guide Truic

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Gameday Ncsu Women S Boot Ncs L052 1 Womens Boots Boots Gameday Boots

Pin On Events At Raffaldini Vineyards

Alcohol Taxes In The U S And Around The World Infographic Zone Pinterest Alcohol

Is Food Taxable In North Carolina Taxjar

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Budget Food Shopping Harris Teeter

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards

Understanding Sales Tax With Printify Printify Sales Tax Understanding Tax Exemption

Is Food Taxable In North Carolina Taxjar

Cuisine Classique Menu And Prices Epcot 2017 Festival Of The Arts Epcot Festival Food Network Recipes

What A Time Shirt Rose Foods Tee Shirt Designs Graphic Tee Design Tshirt Design Inspiration